Card Payments

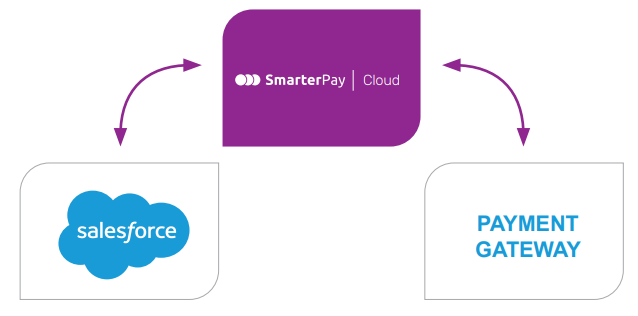

SmarterPay Cloud acts as a bridge between Salesforce and the payment gateway of your choice, ensuring customer payments are managed and represented correctly in Salesforce.

Card Payment Options

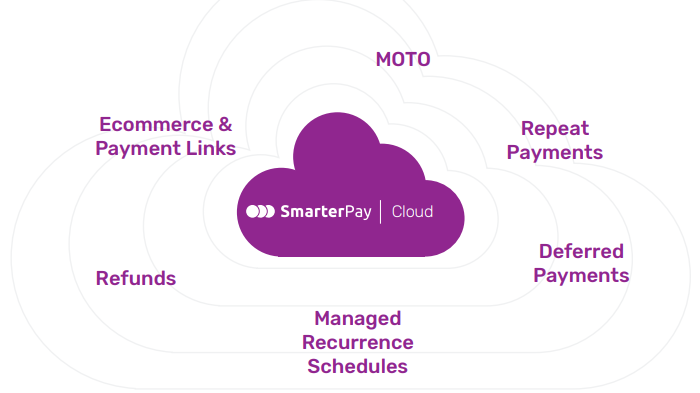

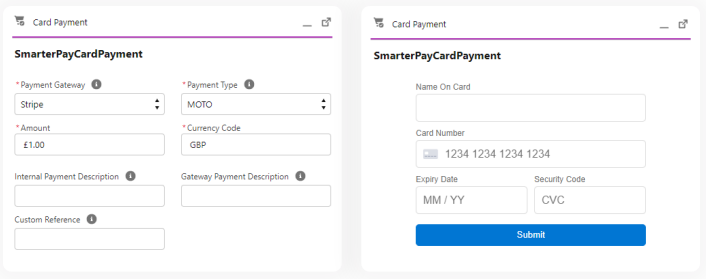

Moto Payment

Within minutes of installation, PCI-Compliant MOTO card payments can be taken within Salesforce. Simply click on the SmarterPay App and select 'Card Payment'.

This standard flow can be extended to meet any business processes required when taking a card transaction. More complex requirements can be fulfilled by using SmarterPay's included Apex classes and API.

Ecommerce & Payment Links

SmarterPay also offer online payment integration that can be completed by your customers.

We offer a range of services for online payments. With all options, our dedicated development and client services team will help you every step of the way.

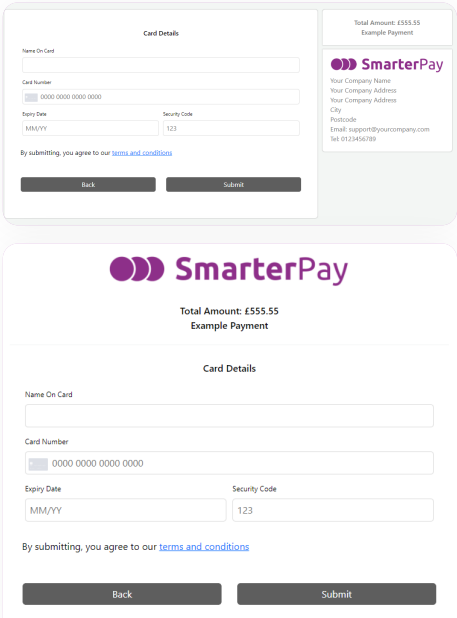

SmarterPay Payment Link

SmarterPay offers customisable out of the box online payment links. Links are generated and managed completely in Salesforce, or as part of an external API request for full flexibility. Your customers can be sent the link via email within Salesforce, via SmarterPay Cloud’s email service or even integrated as part of a checkout process.

Bespoke Web Pages

If SmarterPay’s out of the box solution does quite fit your business, our dedicated and experienced development team can build bespoke webpages for you to match your branding and online payment processes.

SmarterPay API Integration

If you have your own development resource, we provide a series of easy to consume API endpoints to generate Card Payments. This empowers you to integrate SmarterPay quickly and seamlessly into existing online payment websites and processes.

Refunds

Refunds are provided as standard with the SmarterPay Card Payment installation and allow for partial or full refunds.

They can be accessed out of the box via the 'Refund' button the Card or specific Payment record. For example, you can perform automated refunds on any event within Salesforce, such as a field change on an 'Opportunity'. You can even request refunds from external systems using our easy-to-use API.

Deferred Payments

SmarterPay’s payment gateway integrations enable you to 'swipe' a card and request funds later. SmarterPay can offer two specific types of deferred payments:

Pre-Authorisation

A short term 'shadow' on a customer’s bank account for a specific amount and available for up to 7 days. This amount will be taken off the customer's available balance.

Authenticate and Authorise

A longer-term agreement between business and customer. Depending on Payment Gateway, these requested funds can be available for up to 90 days. The difference here is that funds are not 'shadowed' on a customer's account.

Recurring Payments

SmarterPay provides a series of out-of-the-box solutions for recurring payments depending on your requirements:

Single Repeat Payments

Ad-hoc repeat payments can be made manually in Salesforce in a few clicks of the mouse using SmarterPay’s out of the box component or automatically using our easy-to-use API.

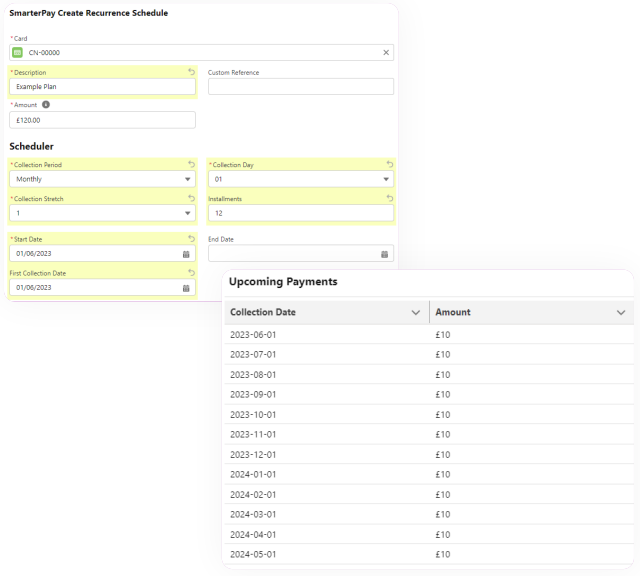

Managed Repeat Payments

Simply set up a schedule against a Card and SmarterPay will manage the rest. SmarterPay offers two types of managed recurring schedules:

Ongoing Payment: A regular amount taken at set intervals; with or without an end-date. This is typically used for memberships or subscriptions.

Payment Plan: A set amount paid over weeks, months, or years. These are used to pay for specific services or products; for example, monthly payments to pay off a large purchase.