Bulk Change Process of Direct Debits

The Bulk Change Process (BCP) of transferring Direct Debits is an easy way to move existing Direct Debit Mandates from one AUDDIS Service User to another Payment Service Provider in Bulk when one of the following changes has occurred:

- Company Name

- Legal Status (Transfer of business from one entity to another, for example)

- Service User Number (SUN)

- Service User Reference (SUR)

To perform this task, the following needs to apply regarding making a BCP:

- Customers need to be notified of the change, although they have no action that needs to be taken to complete this.

- The New SUN owner agrees (If this is for a change in SUN), and so does the associated sponsoring bank.

- The Old SUN owner agrees (If this is for a change in SUN). They should aid in this matter.

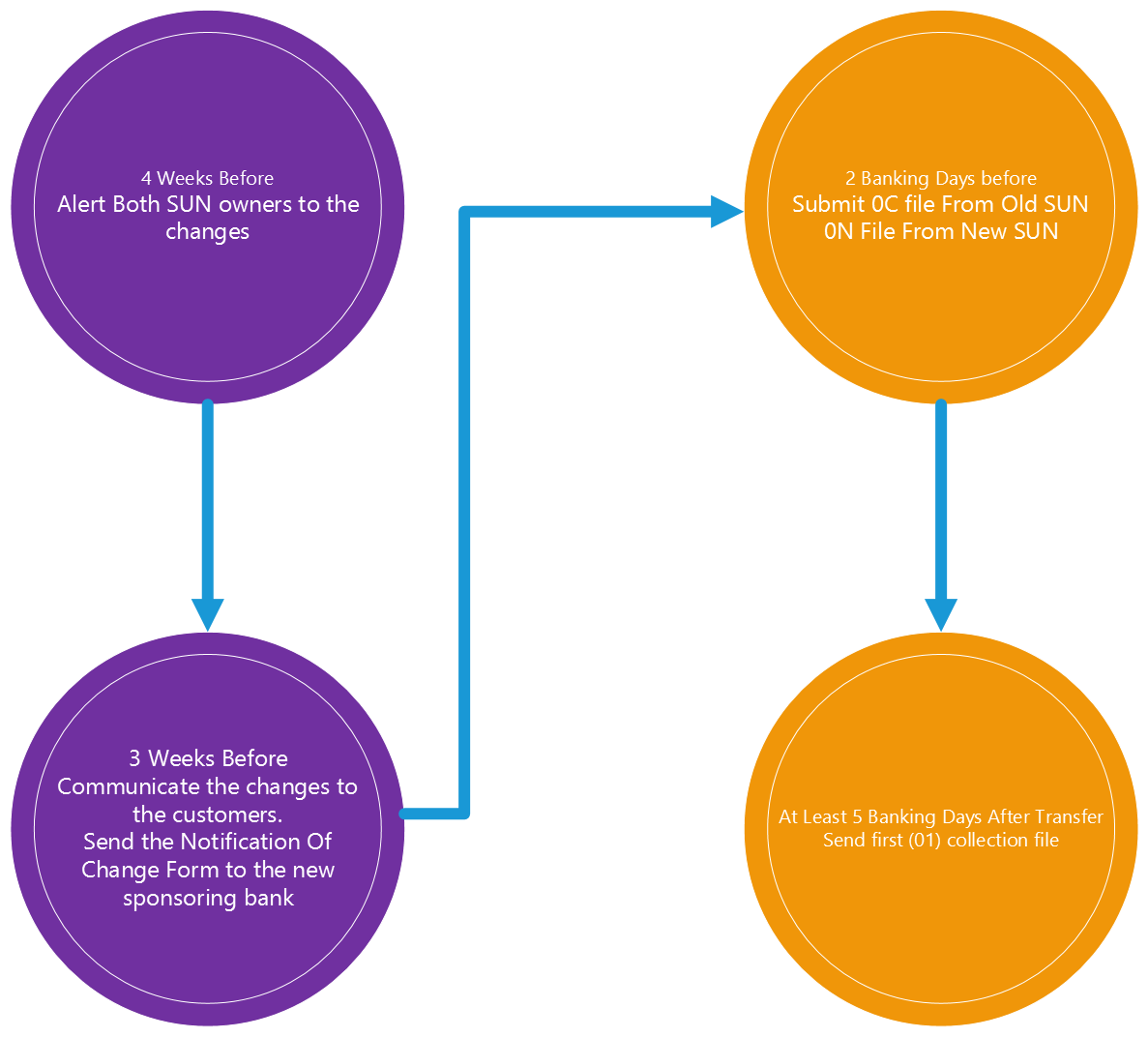

This process can vary on the length of time to complete, given that multiple bureaus are involved and the speed of processing the paperwork. Below is an example of what happens and with who:

- At least 4 weeks prior to switching:

- Both SUN owners must be notified of the changes occurring. They will then be able to contact their sponsoring banks, to allow them to perform their checks, before agreeing to the change.

- Start drafting communications to customers dependent on the case above. An example of customer communication can be found here.

- Complete the Bulk Change Deed Form and return it to Sponsor.

- Around 3 weeks before change:

- Send communications to customers confirming the impending changes are to occur.

- Creation of ‘0C’ and ‘0N’ or ‘0S’ (for Non AUDDIS Compliant), with the ‘0C’ file containing the old SUR, and the ‘0N’ containing the New SUR, to prepare for submission as part of the transfer.

- Send a Notification of Change Form, which will provide the New SUN’s sponsoring bank of the quantity of records, and the date of the change.

- 2 working days before change:

- Submit file of ‘0C’ and ‘0N’ files to Bacs to initiate change.

- Prepare a Direct Debit Collection File under transaction code ‘01’ to make first collection under New SUN details.

- Monitor any ADDAC’s advices received during this process and update the first collection file prior to submission.

- At least 8 working days after transmission of ‘0C’ and ‘0N’ File:

- Send ‘01’ first collection file through to Bacs to make initial payment run since change.

Points to consider when undertaking this process:

- Any Direct Debit Indemnity Claims Advices (DDICA’s) received on the old SUN received since this BCP must be redirected to the new SUN/Sponsoring Bank to process as they will now be responsible for these records.

- Any payments setup with a previous Payment Service Provider will need setting up again through the new provider, as this transfer only includes Direct Debit Mandates, not payments.

- It is the New SUNs responsibility to arrange transfer of any rejection reports from the old SUN. If there is any concern over the status of a Direct Debit Instruction, then this should be confirmed with the Payer.

Data Requirements for FM Providers

The following is for quality and content of data provided to complete a switch (transfer) by an FM Client via the BCP:

- Data is to be provided by the ceding provider electronically (i.e., not via/as pdf).

- Date is to be provided in a secure format:

- The data format is agreed between the ceding and acquiring provider (if not provided to/by the client).

- The data is to be up to date when provided, i.e., ADDACS advices have been applied as have any instructions directly from payers.

- Data is to be provided on a timely basis to meet the agreed transfer date and the needs of the acquiring provider.

- Data is also to be provided after the Bulk Change deed is completed, and ideally 7 working days before the agreed switch date or as agreed with the client.

- The ceding provider is to make available as much client/payer related data as is available, including as a minimum:

- The payer’s name.

- The payer’s account details (account number & sorting code).

- Payer’s contact details –e-mail, and/or address, and/or telephone number.

- A schedule of payments that are due including the next payment date and frequency.

- The existing advance notice period.

- The purpose and content of any additional data fields should be clear, supported by an explanation where appropriate.

Best Practice Requirements

The data should include the DDI date or the date of the first collection.