Standard Credit Process

The Salesforce Direct Credit Service works on the BACS 3 Day Processing Cycle. This means that a file will be generated based on relevant direct credit information in Saleforce 2 banking days before the collection day. Detailed information on this process can be found here.

BACS Rejections (ARUCS) are processed by the system automatically and Salesforce is informed of any credit failures. This again follows the standard BACS workflow which can be found here.

Direct Credit (Income_Direct_Credit__c)

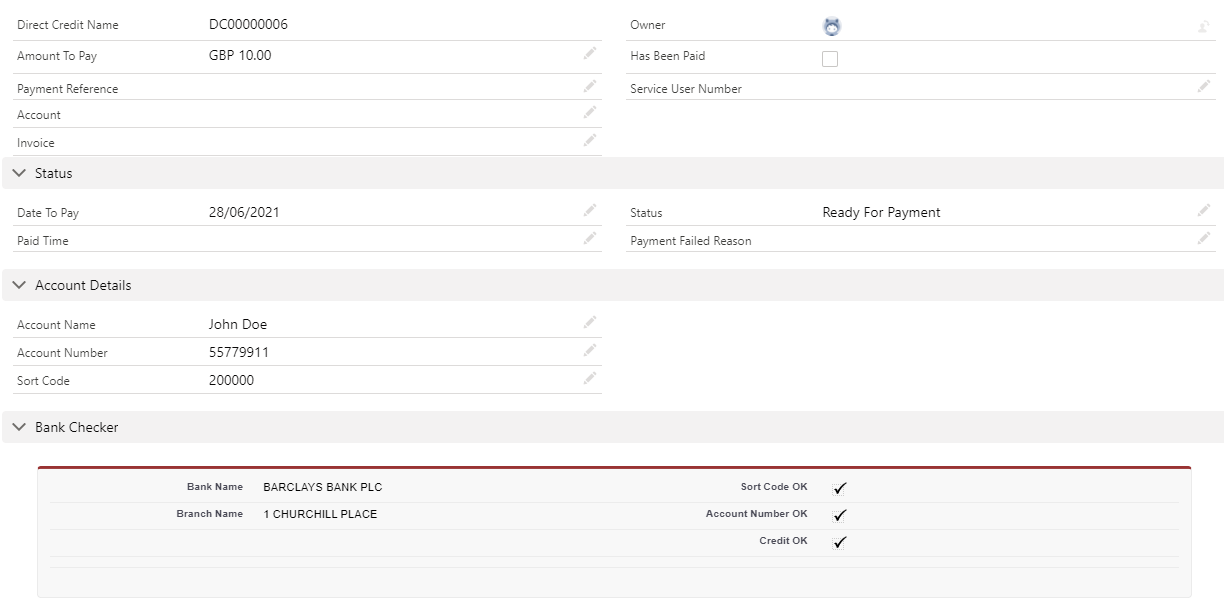

The Direct Credit object is a representation of the transaction that is sent to BACS to perform the credit. It contains details of the credit, such as the amount to send and where to send it to (the bank details); there are also some basic options around scheduling the credit to be sent to BACS.

The SmarterPay DDMS service automatically picks up any credits that need to be sent to BACS. This is based on the “Date To Pay” and the “Status” field. If the status is set to “Ready For Payment” then the service will pickup the record on the relevant date, generate a file and send to BACS automatically.

Error files are retrieved from BACS and processed against the credit records in Salesforce so any issues with a credit can be seen.

| FIELD | DESCRIPTION |

|---|---|

| BANK SORT CODE | Sort code of the destination bank account. |

| BANK ACCOUNT NUMBER | Account number of the destination bank account. |

| BANK ACCOUNT NAME | Name of the account holder for the destination bank account. |

| AMOUNT TO PAY | The amount of money that should be sent to the recipient of the credit. |

| DATE TO PAY | The date that the money should appear in the recipients account. |

| STATUS | The current status of the credit. This is typically defaulted to “Created” and is then manually or automatically moved to “Ready For Payment” when the credit has been approved to send. |

| PAID TIME | The date/time that the credit was sent to BACS. |

| PAYMENT FAILED REASON | The reason why the credit failed according to the report received from BACS. |

Creating a Direct Credit

Creating a credit to send is as simple as entering the bank details of the recipient, the amount that they should receive and the date that the credit should be paid into their bank account.

Bank details entered into the page will be checked for validity using modulus checking against the Extended Industry Sort Code Directory (EISCD). Success or failure is represented by a component included on the record view page. SmarterPay will not attempt to send a credit for a record which does not successfully pass modulus checking.

By default, to Status of the Credit is set to “Created”. This gives users the opportunity to make sure that the credit details are definitely correct before sending it. This also accommodates for an Approval Process to allow those responsible within the company to approve the credit before sending.

Once the credit is checked and approved the status can be changed to “Ready For Payment”; this lets the SmarterPay DDMS know that it needs to create a credit file and send it to BACS. The status can be changed manually through the Salesforce user interface or part of a more complicated automatic process.