Introduction

Introduction

This guide will explain how to use SmarterPay, the SmarterPay Ltd. solution approved by Bacs, which works with Bacstel-IP ® to give you secure access to the Bacs ® electronic funds transfer service.

In this guide we will provide some definitions of terminology used by Bacs and by our software, but for complete information about Bacs and Bacstel-IP, please refer to the documentation provided by Bacs.

This guide assumes a certain level of knowledge about Bacs since, to require our software, your organisation must already have one or more Service Users and must therefore have acquired one or more Customer Numbers and an account hierarchy. Again, if you are not familiar with these terms, please refer to the documentation provided by Bacs.

This guide also assumes that you have another software package which can produce payment files for importing to SmarterPay.

Bacs

The Bankers Automated Clearing Service (Bacs) is one of the world's largest automated clearing houses. It is owned by the UK's largest banks and building societies and operates under the umbrella of the Association for Payment Clearing Services (APACS).

Bacs provides an electronic funds transfer service (EFT service) which can be accessed via a dedicated access channel, Bacstel-IP, using Bacs approved software.

Electronic funds transfer falls under the broad categories of Direct Debit, Direct Credit and Direct Debit Instructions, performed in Pounds Sterling. It should be noted that Bacs does not support Euro payments.

Bacs approved software, such as SmarterPay, allows a Bacs registered user to submit any of the supported transaction types to Bacs for processing.

The Bacstel-IP system uses electronic reports (XML & HTML) to contact users – this service replaces all existing Bacs paper reports. The reports are used to convey all information made available by Bacs to the customer, regarding pending or executed EFT transactions, and the state of any unpaid credits and unapplied debits.

Bacstel-IP

Bacstel-IP is the new secure web-based interface that you will now use to connect to the Bacs system. Using SmarterPay you will be able to send information directly to and receive reports directly from a Bacs private network (extranet) or via the Internet.

SmarterPay

SmarterPay is a Windows-based client/server multi-user Bacs-approved solution that replaces your old Bacs-approved software or provides you with the ability to connect to Bacs. It can be used by any market sector, by single companies or by bureau acting on behalf of more than one company.

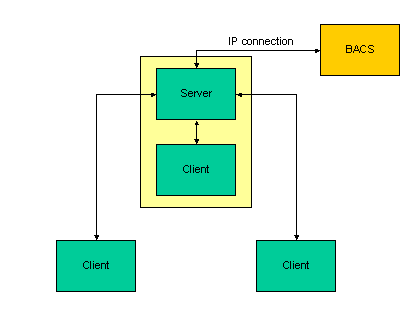

The client/server architecture permits multiple users to access the server from different locations. All data is held on the server to ensure integrity, but is accessible to all SmarterPay clients. Data can therefore be backed up from the server for complete security. Access to Bacstel-IP is via the server but can be instigated from any client. A typical set-up taking advantage of the client/server architecture is illustrated in the diagram below.

The diagram shows the server and a client installed on one machine, with two further clients installed on separate machines. Each client may access Bacs via the server.

More:

Data processing in SmarterPay

SmarterPay enables a large business to track, and automate as far as possible, the process of importing, validating, signing and transmitting Bacs data. Separate configuration and submissions applications are provided. Different user permissions are required to run each application, so that specific users can be prevented from accessing sensitive areas, such as the configuration application, or from performing actions requiring a high degree of responsibility, such as signing submissions.

Once you have configured the SmarterPay system, using the Administrator, you can use the Submissions application to connect to Bacstel-IP. The Submissions application handles everything relating to the Bacs financial services system and is divided into four sections: Payment Files, Active Submissions, Archived Submissions and Reports.

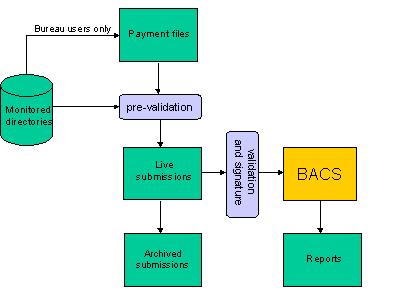

The processing path is illustrated in the diagram below, and described in more detail in the following paragraphs.

Payment files are imported into the Submissions application from one or more monitored directories, either as payment files or as active submissions (depending on the configuration set up for individual service users). If imported as active submissions, each submission will contain only one payment file.

Some validation of the payment file is performed during the import process, to ensure that the file itself is valid.

Whether the file has been imported as a payment file or as an active submission, details of each payment file are accessible from the Payment Files page. From here, certain details of the payment file can be amended if necessary.

The main validation of the payment file account details is performed when a payment file or an active submission is signed.

All submissions must be signed by an authorised system user before being submitted to Bacs. Payment files need only be signed if you have selected the “Payment files must be signed” option for a service user in the Administrator.

Once a submission has been signed and successfully submitted, Bacs sends back reports to notify the service user of the submission's progress through the Bacs system. These reports can be looked at in detail on the Reports view of the Submissions application.

Once the Input report for a specific submission has been received and read, the submission can be archived. Archiving may be done automatically or manually, depending on how you prefer to configure it.

Security in SmarterPay

One of the keynotes when dealing with Bacs is security.

Any software used by Bacs customers to connect to Bacstel-IP must fulfil the stringent requirements specified by Bacs. The software must provide at least the base functionality required by Bacs and must pass the strict security tests set out in the Bacs testing programme. SmarterPay has fulfilled all the conditions stipulated by Bacs and has therefore been designated by them as approved software.

In addition to Bacs security requirements, the SmarterPay software provides further security devices in the form of permissions granted or denied to individual users of the software.

To fulfil the Bacs security requirements at least two users are required to use a smart card and smart card reader. Smart card readers are obtainable either from your bank or from SmarterPay Ltd, your software supplier. These users are the primary security contacts required by Bacs.

The smart card contains a personalised digital certificate which allows you to create an electronic “signature” whenever you use it.

The smart card and reader, together with permissions granted in the Administrator, enable the user to carry out the following functions:

- Sign payment files and/or submissions

- Log on to Bacstel-IP

- Send submissions to Bacs

- Access reports

SmarterPay in your company

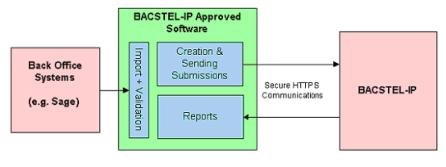

The diagram below shows where the SmarterPay software fits into your existing systems. It acts as an interface between back office systems capable of producing payment files, and the Bacstel-IP service. The software provides validation of imported data, creation and sending of Bacs submissions, and the downloading and viewing of reports created by Bacs. All communications are performed using secure channels of communication with the latest PKI security (Public Key Infrastructure).

SmarterPay functionality

The following functionality and features are provided by the software:

Bacs approved software

Supports all Bacstel-IP core functions to approved standard

Regular updates from the Industry sort code directory

Provides access to all Bacs report types

Accepts data of any format from any back office application

Suitable for bureaux and individual companies

Supports multiple Bacs user numbers

Simple and intuitive interface for creation of single and multiple file submissions

Security features

Supports a flexible user and user groups environment

Software functionality restrictions based on user privileges

Password protected access

Stores data in encrypted format

Full support for smart card and PKI technology

Supports usage of HSMs for automated file processing

SSL client-server connections

Validation features

Account number modulus checking

Sort code validation against Industry sort code directory

Data validation as per the Bacstel-IP Technical specification

Individual record value and monthly account limit checks

Audit and reporting functionality

Full audit trails

Searchable record of submissions transmitted to Bacs and reports received from Bacs

Bacs reports may be previewed and/or printed

Reports available in XML and XHTML format

Email alerts can be sent during various stages of the submission process

Architecture

True multi-user client/server architecture

Platforms supported

64bit (x64, not ARM64) Windows Operating System

- Windows 10, or greater

- Windows Server 2016, or greater